Composing A Monetary Intend On Your Own

Composing A Monetary Intend On Your Own

Blog Article

I believe that we have all the same dream. That dream is to be rich - rich enough without requiring to work to attend to all of our needs, without being a slave to money and without worry of not having enough. Well, aren't we dreaming about retirement? Yes! Retirement is all about living well without working. You can work if you like it, however you do not have to force yourself.

Action # 6: Inventory Your Insurance. While there are numerous types of insurance the type we have an interest in here are life, medical, impairment and long-term care.

Governments of US/UK have advanced different such provisions in their financial preparation. There is a tax refund offered on the retirement saving plans. One such conserving plan is the Roth IRA plan. Roth IRA indicates "private retirement account". It is called after chief legal sponsor "William Roth".

John & Mary live a life of high-end-- John, 56, and Mary, 52, play golf every early morning, sit by the swimming pool in the afternoon, and enjoy wonderful programs in the night. The very best part is that they are not rich at all. They have actually merely used some penny-wise early retirement planning that enables such an early retirement lifestyle.

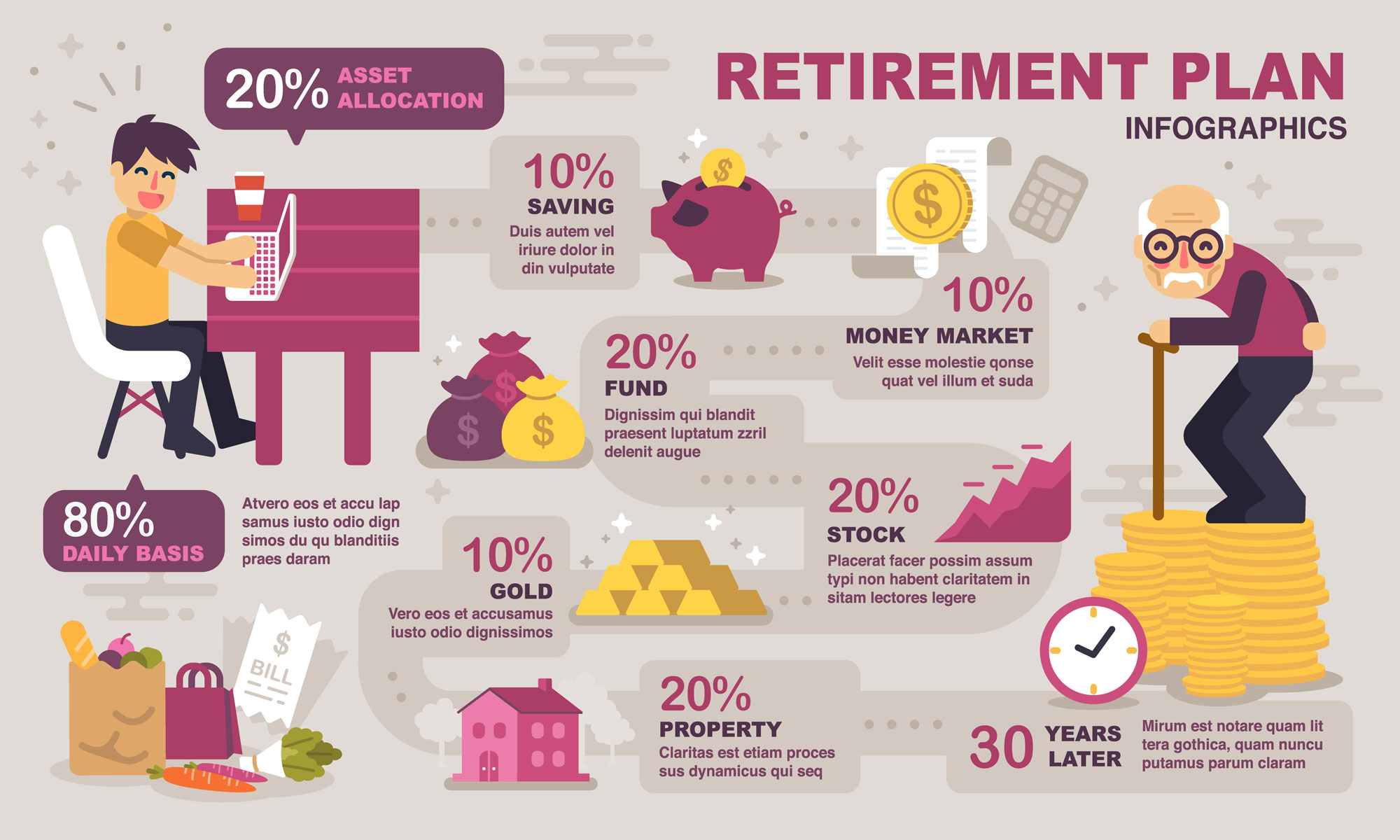

The basic things to bear in mind is start as early as possible and purchase ideal possession class. The greatest advantage of starting early in power of compounding.

Individuals do live long: If you are the type of person that likes to live for the moment and your specialty is figuring things out when they occur I wouldn't depend on having a smooth retirement if you do not put a plan in place now.

(ii) E-trade- E-trade has been rated as one of the most reputed online brokerage. Apart retirement activities from IRA services they likewise provide other banking services. They provide $9.25 stock bonds and same as Scott trade has no account costs or minimum balance constraints.

If this sounds like a reasonable approach to create a retirement strategy then look for my future articles where I'll go into greater detail on each step.